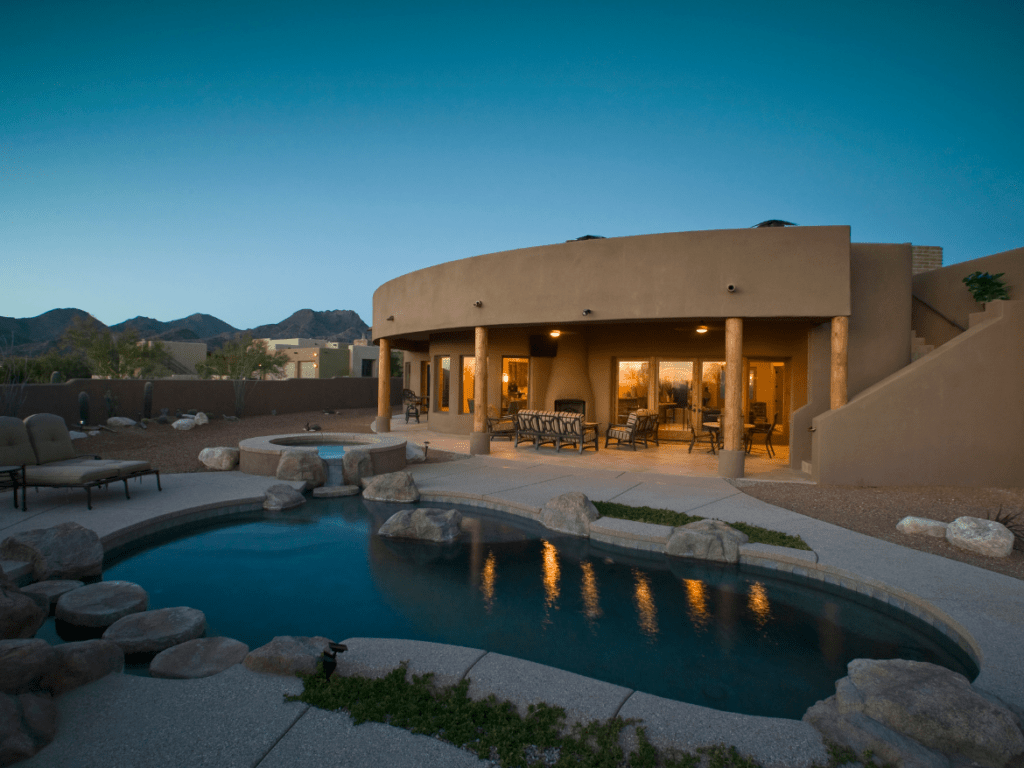

Whether you are thinking about putting your home on the market or simply want to keep up with the market value of your largest investment, it’s helpful to understand the primary factors that can impact your home’s value. While homes in the same neighborhood may have comparable values, a number of things go into determining a home’s value that can differ from home to home. Here is a look at some of...

Off-Market Homes

Housing inventory was thin going into the pandemic and has remained that way into 2021. Part of the reason is that homeowners who would have put their house up for sale in a normal year, held back. With low interest rates continuing to drive demand and low inventory keeping the market extremely competitive, the simple economic laws of supply and demand have led to rising home prices amidst a...

Yes, it’s a competitive world out there if you’re a homebuyer. But you can’t win if you don’t get in the game. That’s not to say every house you look at is going to be worth making an offer. There are plenty of very legitimate reasons for not making an offer, such as serious structural issues or a price that is way over budget, to name but a few. But, let’s face it. Sometimes,...

A home purchase is a major commitment–likely the largest purchase you’ll make in your lifetime. Before you get too far down the road to homeownership, you need to be sure you’re prepared for the home-buying process. To get started, ask yourself the following six questions: 1. Do you have verifiable income and employment? While it’s true that your mortgage lender will want to be able to verify your...

It’s a fact. All the events of 2020 left more and more would-be homeowners buying a home, sight unseen. That trend continues. Homebuyers purchasing a home they had not previously seen in-person is nothing new. People making long-distance relocations have been making use of the Internet and trusted agents for quite some time now. But, it’s only recently that this trend saw a steep incline in the...

Homeownership is certainly not without its costs. Saving for a down payment and coming up with closing costs are just the beginning. Covering costs like maintenance, repairs, insurance, and HOA fees are among the expenses that soon become too familiar with new homeowners. But the alternative—renting—also comes with its own slate of costs. The choice of whether it is better to buy or rent has...

You’ve saved your down payment, you’ve gotten your pre-qualification from your lender and even made your list of priorities. But, before you start that home search, here are seven things to keep in mind: Plan ahead so you don’t lose out. There’s nothing worse than finding the house of your dreams only to lose out to another buyer because your financing wasn’t in order. Don’t wait until...

If you’ve been renting, you may wonder whether it makes sense to buy a home. You may have heard that inventories are tight right now or that the home-buying process is challenging. Maybe you have questions over the financial side of buying a home—and whether it’s better to rent or buy. If you’re still trying to figure out whether it’s better to rent or to buy, here are seven reasons you may...

When it comes to you home, memories at priceless. Unfortunately, those good times are of no use when trying to come up with an objectively derived price for your home. This is where an agent comes in. As your agent, I can provide you with an estimate of your home’s value, show you comparable sold properties and recommend a list price for your home. Ultimately, though, you control the...

Most new homeowners decided to go from renter to homeowner because they had saved a sizable down payment, and either they or a mortgage lender determined the costs of home ownership were no greater than 30% of their income. But what if you’re retired and on a fixed income? Suddenly deciding between renting and buying isn’t so simple. No matter why you’re moving as you enter...