A home purchase is a major commitment–likely the largest purchase you’ll make in your lifetime. Before you get too far down the road to homeownership, you need to be sure you’re prepared for the home-buying process.

To get started, ask yourself the following six questions:

1. Do you have verifiable income and employment?

While it’s true that your mortgage lender will want to be able to verify your income, they’ll also want to verify that you have a steady work history. Most of the time, your lender will verify your employment going back two years. If you’ve changed jobs during that time, be sure you don’t have any significant lapses in employment status and that your current job shows you at or above any previous job’s income.

Keep in mind that if you have been claiming a loss for your side business, this can decrease your income in the eyes of a lender when figuring your debt-to-income ratio. If you are self-employed, expect to provide your tax returns at minimum.

2. Does your debt-to-income ratio support your desired price range?

Your debt-to-income ratio or DTI is an important financial tool mortgage lenders use to evaluate your loan application and determine how much home you can afford. The DTI is one of the primary measures your lender uses to determine how much additional debt–by way of a mortgage–you can take on. It is calculated by dividing your monthly debt by your gross monthly income. Although the number varies based on your lender and type of loan, you’ll likely need a DTI of 50% or lower to qualify for a mortgage.

3. Do you have enough liquid assets to cover a down payment and closing costs?

One of the most obvious costs is the down payment. The amount of your down payment will depend on the loan type and the amount of money you borrow, but typically you can expect to put a minimum of 3% down in addition to the down payment.

In addition to your down payment, you’ll usually need cash for closing costs. These are the fees that the lender and title company charge for the services they provide in connection to your home purchase, as well as other costs, such as a title transfer fee or deed registration. You can budget about 3% to 6% of your home’s value in estimating these fees.

4. Is your financial house in order?

Your credit score plays an important role in helping your mortgage lender determine if you are a good credit risk. In addition, your credit score determines how good your interest rate will be. A higher credit score can ensure you are getting the best possible interest rate and other loan terms.

Most lenders will require you to have at least a 620 credit score to qualify. Boosting your score to 720 or more will provide you with the best loan terms.

5. Are you prepared to stay in one place for several years?

While you don’t have to commit to staying put for the duration of your 30-year mortgage, you will want to be ready to live in your new home for an extended period of time in most cases. It’s more complicated to move when you own a home, in most cases. Career goals, family obligations and other factors will determine how likely you are to stay comfortably in one place for several years.

6. Does the timing make sense for you?

Current mortgage rates have been getting a lot of attention because they have reached historic lows, making it an excellent time to purchase or refinance a home. While this may signal that you should take advantage of great rates, there are other factors that have to be addressed as well. Family issues, the start or end of a school year, potential major expenditures and other issues can impact your individual situation. You may even want to consult a financial expert to help you answer the question of timing.

Unlisted Homes For Sale

Off-market homes you will not find anywhere else. Get access to incredible deals.

Amplify Your Profit Potential in North Phoenix

- Asking $250,000

- Beds: 3

- Baths: 2

- 1352 sqft

- Mobile Home

Investor Alert: Great Deal in Goodyear

- Asking $195,000

- Beds: 3

- Baths: 2

- 1248 sqft

- Mobile Home

Exceptional Pre-Foreclosure Investment Opportunity in Tolleson

- Asking $325,000

- Beds: 4

- Baths: 2

- 1889 sqft

- Single Family Home

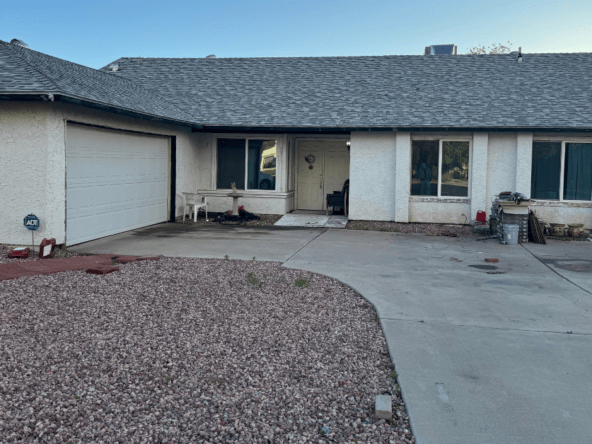

Transformative Potential with Outstanding Profit Margins

- Asking $275,000

- Beds: 2

- Baths: 2

- 1457 sqft

- Single Family Home

Seize the golden opportunity for a quick flip in Mesa

- Asking $350,000

- Beds: 4

- Bath: 1

- 1660 sqft

- Single Family Home

Profit in Scottsdale’s Prestigious Eagle Point

- Asking $450,000

- Beds: 2

- Baths: 2

- 1141 sqft

- Townhouse

Profitable Flip or Rental Opportunity Awaits in Mesa

- Asking $360,000

- Beds: 3

- Baths: 2

- 1604 sqft

- Single Family Home

Low-Effort High-Return Investment in Peoria

- Asking $199,000

- Beds: 3

- Baths: 2

- 1496 sqft

- Mobile Home

Your Next High-Profit Opportunity Awaits in Laveen

- Asking $380,000

- Beds: 5

- Baths: 3

- 2616 sqft

- Single Family Home

Exceptional Chandler Home Priced to Sell Fast! Unbeatable Offer Awaits

- Asking $765,000

- Beds: 5

- Baths: 3.5

- 3168 sqft

- Single Family Home

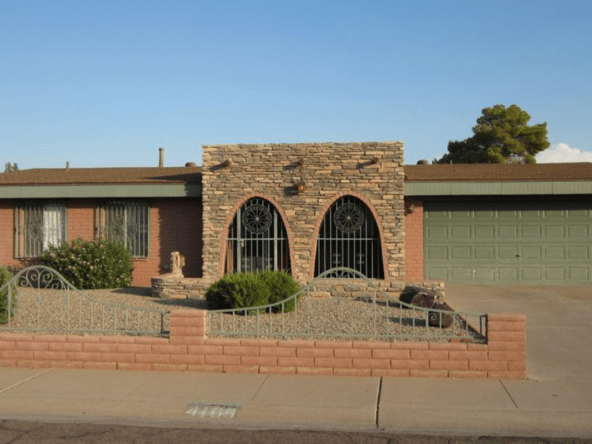

Unlock Exceptional Investment Returns in Dobson Ranch

- Asking $305,000

- Beds: 3

- Baths: 2

- 1221 sqft

- Townhouse

Fire Sale: Exceptional Investment Opportunity Awaits in Phoenix

- Asking $399,000

- Beds: 3

- Baths: 2

- 2070 sqft

- Single Family Home

Urgent Sale Required: Turn-Key Golf Course Home in Mesa – All Offers Welcome!

- Asking $375,000

- Beds: 3

- Baths: 2

- 1691 sqft

- Single Family Home

High Profit Potential Property on Spacious Acre Lot

- Asking $410,000

- Beds: 4

- Baths: 2

- 1878 sqft

- Single Family Home

Exceptional Investment Opportunity – Prime for Rental or Quick Flip

- Asking $315,000

- Beds: 4

- Baths: 2

- 1764 sqft

- Single Family Home

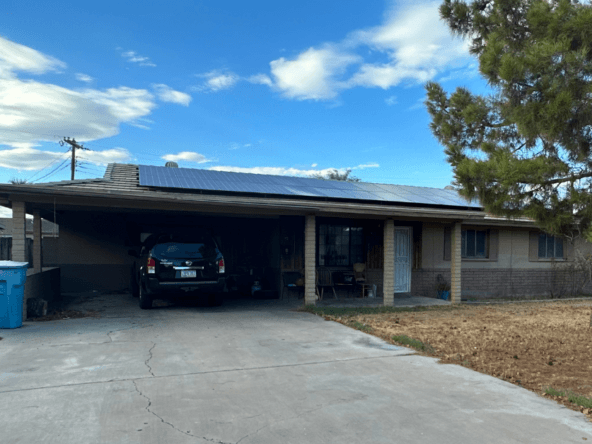

Outstanding Investment Opportunity – Prime for Immediate Rental or Quick Flip

- Asking $310,000

- Beds: 3

- Baths: 2

- 1373 sqft

- Single Family Home

A Lucrative Lakeside Opportunity in Chandler Awaits!

- Asking $499,000

- Beds: 4

- Baths: 3

- 2155 sqft

- Single Family Home

Outstanding Fix & Flip Opportunity: Priced to Sell in North Phoenix

- Asking $299,000

- Beds: 3

- Baths: 2

- 1808 sqft

- Single Family Home

Exceptional Buy-and-Hold Opportunity: 5BR/3BA Home in Lakes Community at a Discounted Price!

- Asking $435,000

- Beds: 5

- Baths: 3

- 2644 sqft

- Single Family Home

Profit with this Rare Off-Market Phoenix Opportunity

- Asking $299,000

- Beds: 3

- Baths: 2

- 1461 sqft

- Single Family Home