Buying a home can be a lengthy process. So, it’s understandable that once you’ve provided all the proper documentation to your lender, you feel like you can relax a bit an enjoy the more fun parts of buying a house. But, if you’ve got a big purchase in mind–maybe some new furniture and electronics–think twice. It’s important that once you’ve completed the application and the...

Mortgage Lender

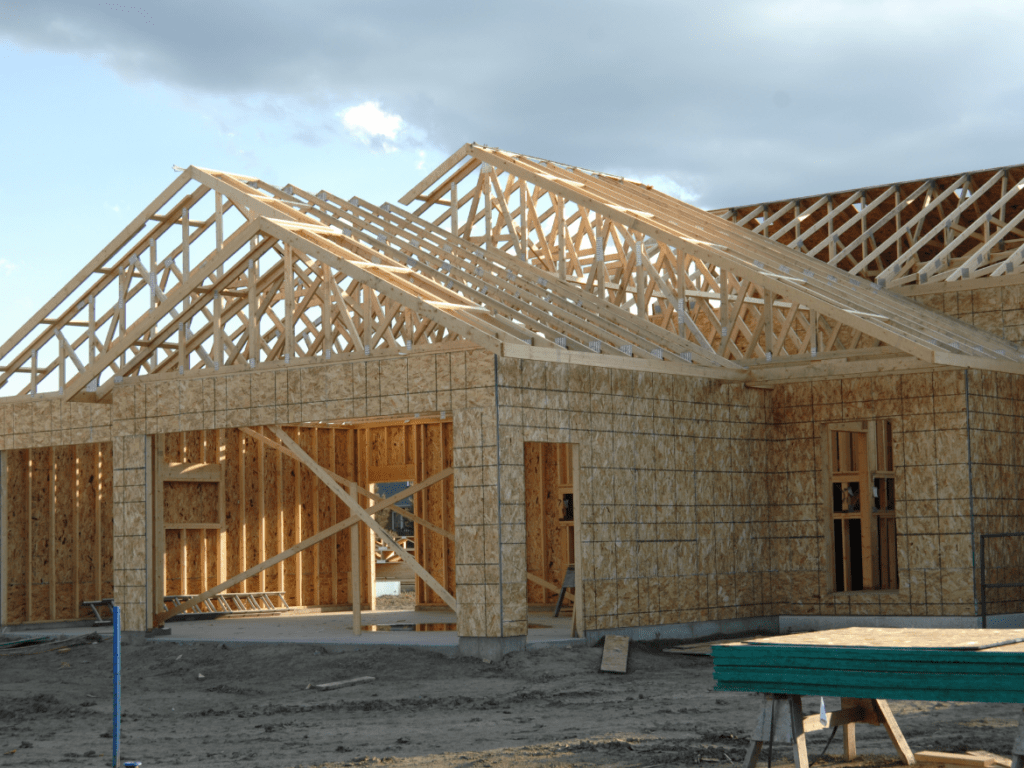

There’s no denying that building a new home—rather than buying an existing one—remains popular with homebuyers. In fact, new home construction increased 5.2% on a year-over-year basis last year. New home starts totaled 1.38 million in 2020. That’s an increase of 7% compared to 2019. If you’re thinking of a new home, you may have given some consideration to new construction,...

The number of self-employed individuals across the country continues to grow, with an estimated 16 million people opting to be their own boss. While the gig economy is booming and self-employment has become increasingly commonplace, the hurdles faced with obtaining a home mortgage remain. Ask any lender and you’ll learn the stark truth: it’s easier to qualify when you can show a W-2. That...

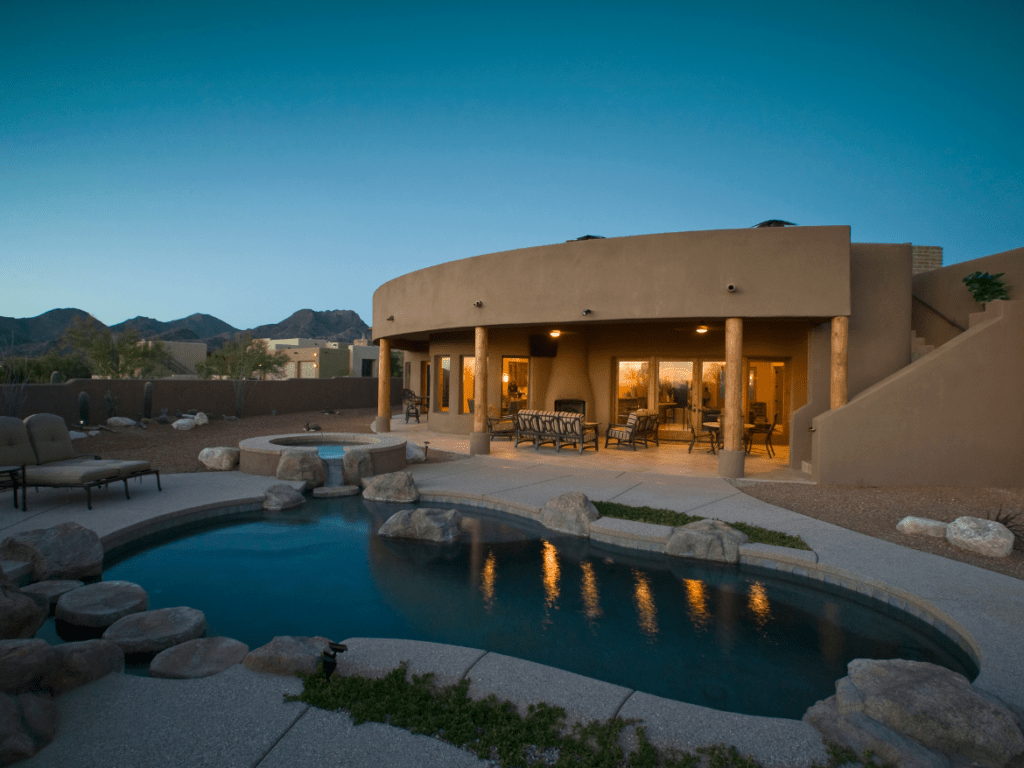

Buying a home is a big commitment, but it also has a great many advantages. If you’re throwing money away on rent month after month, what’s holding you back from making the move to homeownership? The truth is, there are a lot of myths about buying a home that keep people from making the move. But in reality, instead of renting, they could be owning their own home. Here are five of the most...

Buying a home for the first time can be nerve-wracking and exciting, all at the same time. There are so many things to remember, so many considerations to be had and so many decisions to be made. It’s no wonder, then, that some homeowners find themselves committing blunders when it comes to their search for the perfect home. At times, those mistakes can be costly or even get in the way of a...

Whether or not you’re a first-time homebuyer, you’ve probably given some thought to how to negotiate with the seller when it comes to contract time. But most homebuyers focus only on price. While price is critical, it isn’t the only part of the contract you may want to negotiate. Particularly in a market when inventories are low, being able to negotiate on things besides price could help your...

If you are in the market for a new home, you may be wondering exactly what type of loan is right for you? In some instances, you may be able to eliminate a few options right out of the gate. If you or your spouse have no military history, you can eliminate a VA loan. Or, if you’re looking for a home in the city or most suburbs, the property won’t qualify for a USDA loan. The majority of...

There’s no getting around it: financing a home can be full of acronyms and jargon. So, how do you sift through all the language to understand your loan options? Your lender is an invaluable resources when you have questions about your mortgage application or loan. But to give you a head start, here is a primer on two facets of your potential new mortgage you’ll need to understand in order to...

If you’ve just applied for a mortgage–or are getting ready to do so–you probably know what to do ahead of your application, to ensure your financial house is in order. But what about after you’ve submitted your application? You may be surprised to learn there are some important do’s and don’ts for how you address your spending and income, even after you’ve made your mortgage...

You’ve saved your down payment, you’ve gotten your pre-qualification from your lender and even made your list of priorities. But, before you start that home search, here are seven things to keep in mind: Plan ahead so you don’t lose out. There’s nothing worse than finding the house of your dreams only to lose out to another buyer because your financing wasn’t in order. Don’t wait until...