The idea of buying a home can be exciting–especially if it is your first home purchase. Homeownership can offer a number of financial and emotional benefits. While there are several steps to get through before you can start to enjoy homeownership, it’s important to be sure you’re ready for what lies ahead before you start viewing properties.

Here are three important questions to ask yourself as you embark on your new home purchase:

Am I in position to qualify for a mortgage? You could find the home of your dreams, but if you can’t get approved for a mortgage, that dream can be shattered. It can lead to a huge disappointment if you shop for homes before getting your financing on track. That’s why you should get prequalified before viewing even your first home.

Not only will you learn whether or not you are likely to qualify for a mortgage, but your lender can determine just how much home you are likely to afford. When you know where you stand, you can then make a strong offer with confidence. You will also avoid the frustration of shopping outside of your budget.

Do I have enough to cover closing costs? There’s a lot of focus on saving for a down payment. While that’s important, it’s not the only upfront cost you’ll have in buying a home. Closing costs and fees can often run about 3 percent or more of the contracted price.

That means if you are getting a government-backed loan requiring just a 3 percent down payment, you can plan on doubling that amount when it comes to what you will actually need to bring to the table if you want to purchase a home. There are also stipulations on where and how that money is sourced, so be sure to discuss the total anticipated costs–and how you plan to pay for them–with your lender.

Can I afford to buy a home in my preferred neighborhood? Once you have spoken with a lender and become prequalified for your home, it’s time to draw up your list of criteria for finding just the right one. It’s very common for a buyer’s wish list to outpace their budget. Of course, the home’s price is just part of the equation. Consider whether you can afford property taxes, HOA fees, insurance and maintenance on a home in your desired area.

Taking all these additional costs into account can help you evaluate whether you can afford the type and location of the home you have in mind. If not, you may need to compromise. For example, rather than a popular neighborhood, you may need to focus on an adjacent one that is “up and coming.” You may also need to take a few items off your wish list. As your agent, I can guide you on realistic expectations for what you can afford, saving you frustration on your home search.

The bottom line

Before you dive into viewing properties, be sure you have your financial house in order. You will avoid disappointment and ensure you aren’t wasting time if you prepare for your home purchase before viewing that first home. A bit of readiness on your part will have you moving confidently toward the closing table.

Unlisted Homes For Sale

Off-market homes you will not find anywhere else. Get access to incredible deals.

Amplify Your Profit Potential in North Phoenix

- Asking $250,000

- Beds: 3

- Baths: 2

- 1352 sqft

- Mobile Home

Investor Alert: Great Deal in Goodyear

- Asking $195,000

- Beds: 3

- Baths: 2

- 1248 sqft

- Mobile Home

Exceptional Pre-Foreclosure Investment Opportunity in Tolleson

- Asking $325,000

- Beds: 4

- Baths: 2

- 1889 sqft

- Single Family Home

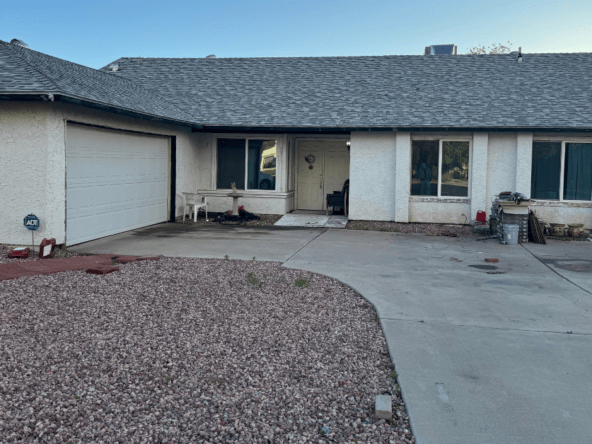

Transformative Potential with Outstanding Profit Margins

- Asking $275,000

- Beds: 2

- Baths: 2

- 1457 sqft

- Single Family Home

Seize the golden opportunity for a quick flip in Mesa

- Asking $350,000

- Beds: 4

- Bath: 1

- 1660 sqft

- Single Family Home

Profit in Scottsdale’s Prestigious Eagle Point

- Asking $450,000

- Beds: 2

- Baths: 2

- 1141 sqft

- Townhouse

Profitable Flip or Rental Opportunity Awaits in Mesa

- Asking $360,000

- Beds: 3

- Baths: 2

- 1604 sqft

- Single Family Home

Low-Effort High-Return Investment in Peoria

- Asking $199,000

- Beds: 3

- Baths: 2

- 1496 sqft

- Mobile Home

Your Next High-Profit Opportunity Awaits in Laveen

- Asking $380,000

- Beds: 5

- Baths: 3

- 2616 sqft

- Single Family Home

Exceptional Chandler Home Priced to Sell Fast! Unbeatable Offer Awaits

- Asking $765,000

- Beds: 5

- Baths: 3.5

- 3168 sqft

- Single Family Home

Unlock Exceptional Investment Returns in Dobson Ranch

- Asking $305,000

- Beds: 3

- Baths: 2

- 1221 sqft

- Townhouse

Fire Sale: Exceptional Investment Opportunity Awaits in Phoenix

- Asking $399,000

- Beds: 3

- Baths: 2

- 2070 sqft

- Single Family Home

Urgent Sale Required: Turn-Key Golf Course Home in Mesa – All Offers Welcome!

- Asking $375,000

- Beds: 3

- Baths: 2

- 1691 sqft

- Single Family Home

High Profit Potential Property on Spacious Acre Lot

- Asking $410,000

- Beds: 4

- Baths: 2

- 1878 sqft

- Single Family Home

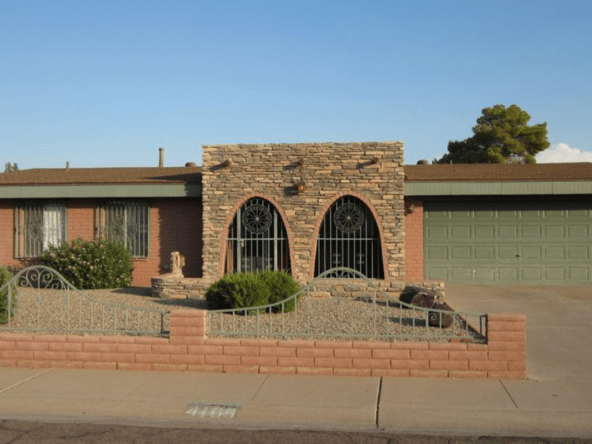

Exceptional Investment Opportunity – Prime for Rental or Quick Flip

- Asking $315,000

- Beds: 4

- Baths: 2

- 1764 sqft

- Single Family Home

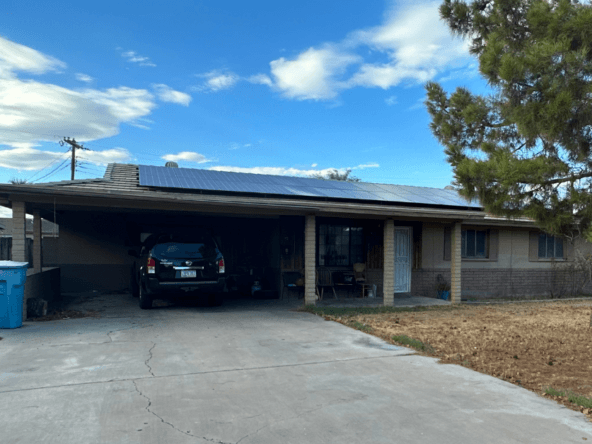

Outstanding Investment Opportunity – Prime for Immediate Rental or Quick Flip

- Asking $310,000

- Beds: 3

- Baths: 2

- 1373 sqft

- Single Family Home

A Lucrative Lakeside Opportunity in Chandler Awaits!

- Asking $499,000

- Beds: 4

- Baths: 3

- 2155 sqft

- Single Family Home

Outstanding Fix & Flip Opportunity: Priced to Sell in North Phoenix

- Asking $299,000

- Beds: 3

- Baths: 2

- 1808 sqft

- Single Family Home

Exceptional Buy-and-Hold Opportunity: 5BR/3BA Home in Lakes Community at a Discounted Price!

- Asking $435,000

- Beds: 5

- Baths: 3

- 2644 sqft

- Single Family Home

Profit with this Rare Off-Market Phoenix Opportunity

- Asking $299,000

- Beds: 3

- Baths: 2

- 1461 sqft

- Single Family Home