Tight supply of available homes for sale has been the story across the country for a number of years now and nowhere is that more evident than here in the Valley. The simple laws of supply and demand have left many buyers disappointed and frustrated. After the crash of 2008, first-time homebuyers in particular were less able, or at least less willing, to take on the large debt of a mortgage. With fewer...

September 2022

If you have fallen behind on your mortgage payment or fear that you are about to be in that situation, you aren’t alone. It’s estimated that just over 10 million homeowners are behind on their mortgage payments currently. So, what can you do? Your best bet is to be proactive. Educate yourself about your potential options as early as possible. The longer you wait to seek out a solution, the...

Making a residential move is a huge undertaking. When that move involves more people in the household than just yourself, it becomes even more complicated. There are plenty of checklists for moving day, but what about the months leading up to your intended moving day? Even if you are just getting started on your home search, there are a number of steps you can take now to make moving day easier on you...

Finding a qualified and experienced contractor can be the deciding factor on whether you are making a sound investment in upgrading your home or throwing your money away. With so much on the line, here are five steps to take in choosing the right person for the job: 1. Begin with a budget. It’s easy for costs to quickly get out of hand if you don’t establish your budget before any...

Homeownership brings with it a number of benefits. But, many homeowners believe the required down payment is well beyond reach. If that sounds familiar, you’ve probably been told you need to put 20% down to purchase a home. On a $300,000 home, that’s $60,000. Add costs for closing, inspection, appraisal and other fees and it’s no wonder a lot of people don’t think they will ever own a...

Buying a home can be a lengthy process. So, it’s understandable that once you’ve provided all the proper documentation to your lender, you feel like you can relax a bit an enjoy the more fun parts of buying a house. But, if you’ve got a big purchase in mind–maybe some new furniture and electronics–think twice. It’s important that once you’ve completed the application and the...

It’s a fact. All the events of 2020 left more and more would-be homeowners buying a home, sight unseen. That trend continues. Homebuyers purchasing a home they had not previously seen in-person is nothing new. People making long-distance relocations have been making use of the Internet and trusted agents for quite some time now. But, it’s only recently that this trend saw a steep incline in the...

If you’re like a lot of people, you probably start out the new year with the best of intentions to finally get organized and defeat clutter once and for all. Then, before you know it, February is here. You look around and realize you have as much clutter as you ever had. Mail is piled up on the kitchen counter. Your work mess is spread out all over the dining room table. Your closet is bursting at...

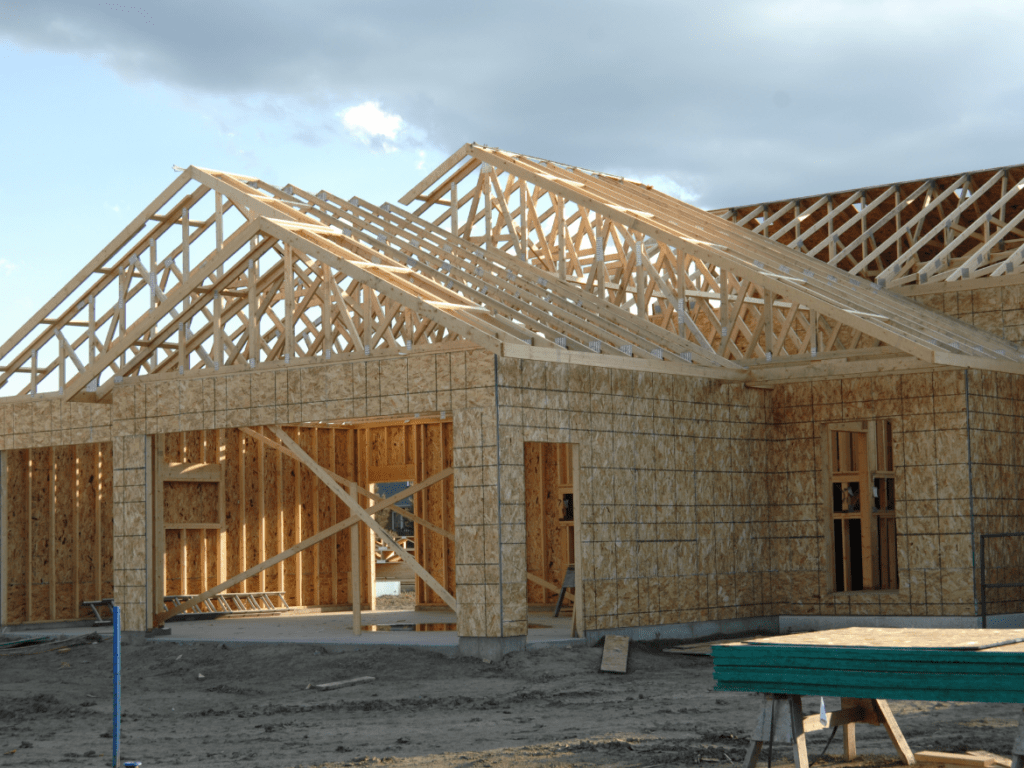

There’s no denying that building a new home—rather than buying an existing one—remains popular with homebuyers. In fact, new home construction increased 5.2% on a year-over-year basis last year. New home starts totaled 1.38 million in 2020. That’s an increase of 7% compared to 2019. If you’re thinking of a new home, you may have given some consideration to new construction,...

The number of self-employed individuals across the country continues to grow, with an estimated 16 million people opting to be their own boss. While the gig economy is booming and self-employment has become increasingly commonplace, the hurdles faced with obtaining a home mortgage remain. Ask any lender and you’ll learn the stark truth: it’s easier to qualify when you can show a W-2. That...