There are a lot of times when a seller wants to sell their home quickly, but that doesn’t always mean they are ready to move quickly. Situations like waiting on a new construction home to be finished, the start or end of the school year, problems scheduling movers or the timing of a work-related relocation are just a few of the reasons a seller may want to stay put for just a bit longer.

Rather than having the seller go through the hassle and expense of two moves, the seller and buyer can agree on a lease back option. Offering a lease-back option can help buyers win the contract, while sellers will appreciate the extra time to move.

How does a lease-back option work?

Lease-back options are usually negotiated at the time of contract. Just like an offer to purchase, a lease-back option is a binding contract that allows the seller to continue to occupy the property post-closing. It is sometimes referred to as a delayed occupancy agreement.

The property still closes as it normally would and the seller receives whatever proceeds they have coming from the sale of the home. The different is that they simply delay their moving date and continue to have full possession and use of he home for a mutually agreed-upon period of time.

There are a few different ways to do a lease-back option. In one scenario, the full amount of rental fees to cover the lease-back period are deducted from the total sum of the purchase contract. Another option is to have funds equal to the agreed-upon rent held in escrow. The buyer then draws from the escrow over the period of time the lease-back agreement is in effect.

The preferred option, however, is to write the lease-back as a completely separate transaction from the purchase. Under this method, buyer and seller enter into a binding contract apart from the purchase. The seller pays rent to the new owner for each month of the lease. This method has the advantage of protecting the buyer because landlord-tenant laws will apply.

Buyers should include a final walkthrough at the end of any agreement to ensure the property is in the same condition as at the time of purchase. Responsibility of the tenant for making an necessary repairs of damage they caused should be written into the lease-back agreement, just as with any lease agreement.

As the owner of the property, the buyer is responsibly for insurance, taxes, HOA fees, and regular maintenance and repairs. For example, if the HVAC system has a problem during lease-back, it is the buyer who will be responsible for repairs and not the seller, who is now a tenant.

As tenant, the seller is responsible for the rental fee, general upkeep and all utilities. They are relieved of the responsibilities of mortgage and other owner-related financial obligations.

Agreements can be a win-win

In a competitive market, a buyer who has the flexibility and willingness to offer a lease-back option may put themselves at an advantage over other potential buyers who want to move in immediately. The buyer can begin to enjoy tax and equity advantages. Both seller and buyer have incentive to maintain the property in its existing condition.

Unlisted Homes For Sale

Off-market homes you will not find anywhere else. Get access to incredible deals.

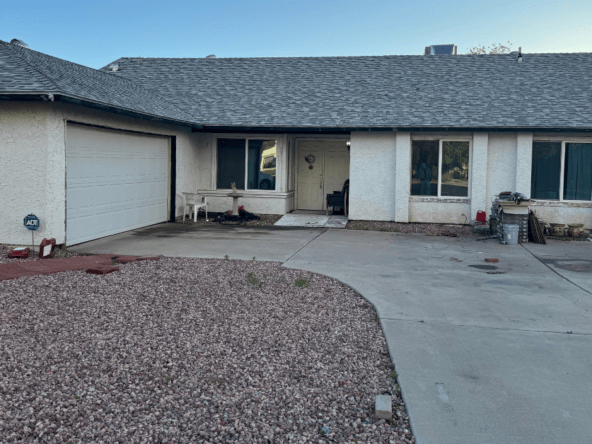

Transformative Potential with Outstanding Profit Margins

- Asking $275,000

- Beds: 2

- Baths: 2

- 1457 sqft

- Single Family Home

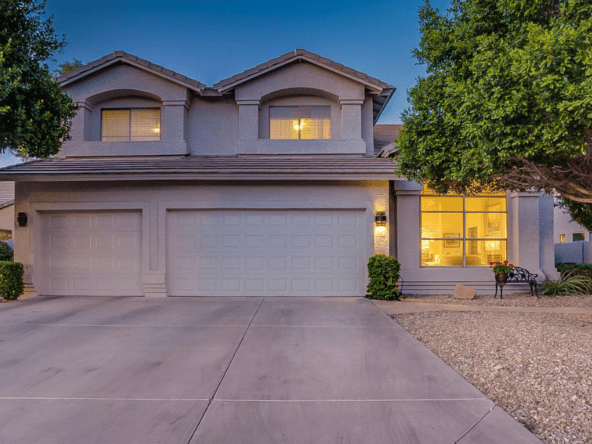

Seize the golden opportunity for a quick flip in Mesa

- Asking $350,000

- Beds: 4

- Bath: 1

- 1660 sqft

- Single Family Home

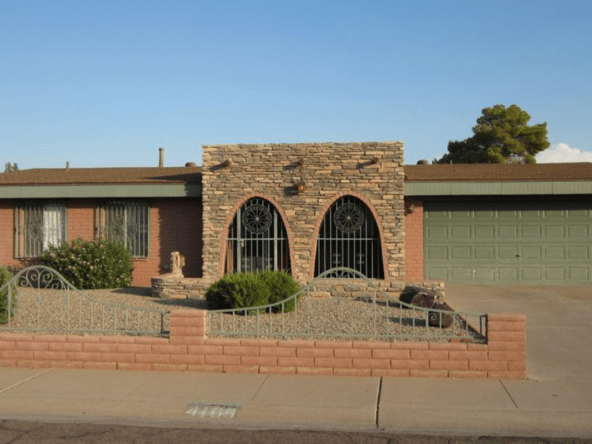

A Prime Property Awaiting Your Touch for Maximum Profit

- Asking $345,000

- Beds: 3

- Baths: 2

- 1719 sqft

- Single Family Home

Profit in Scottsdale’s Prestigious Eagle Point

- Asking $450,000

- Beds: 2

- Baths: 2

- 1141 sqft

- Townhouse

Profitable Flip or Rental Opportunity Awaits in Mesa

- Asking $360,000

- Beds: 3

- Baths: 2

- 1604 sqft

- Single Family Home

Low-Effort High-Return Investment in Peoria

- Asking $199,000

- Beds: 3

- Baths: 2

- 1496 sqft

- Mobile Home

Your Next High-Profit Opportunity Awaits in Laveen

- Asking $380,000

- Beds: 5

- Baths: 3

- 2616 sqft

- Single Family Home

Exceptional Chandler Home Priced to Sell Fast! Unbeatable Offer Awaits

- Asking $765,000

- Beds: 5

- Baths: 3.5

- 3168 sqft

- Single Family Home

Unlock Exceptional Investment Returns in Dobson Ranch

- Asking $305,000

- Beds: 3

- Baths: 2

- 1221 sqft

- Townhouse

Fire Sale: Exceptional Investment Opportunity Awaits in Phoenix

- Asking $399,000

- Beds: 3

- Baths: 2

- 2070 sqft

- Single Family Home

Urgent Sale Required: Turn-Key Golf Course Home in Mesa – All Offers Welcome!

- Asking $375,000

- Beds: 3

- Baths: 2

- 1691 sqft

- Single Family Home

High Profit Potential Property on Spacious Acre Lot

- Asking $410,000

- Beds: 4

- Baths: 2

- 1878 sqft

- Single Family Home

High-Potential Phoenix Property

- Asking $240,000

- Beds: 4

- Baths: 1.75

- 998 sqft

- Single Family Home

Exceptional Investment Opportunity – Prime for Rental or Quick Flip

- Asking $315,000

- Beds: 4

- Baths: 2

- 1764 sqft

- Single Family Home

Outstanding Investment Opportunity – Prime for Immediate Rental or Quick Flip

- Asking $310,000

- Beds: 3

- Baths: 2

- 1373 sqft

- Single Family Home

A Lucrative Lakeside Opportunity in Chandler Awaits!

- Asking $499,000

- Beds: 4

- Baths: 3

- 2155 sqft

- Single Family Home

High Potential Profit in Lindsay Ranch, Gilbert

- Asking $650,000

- Beds: 5

- Baths: 2.5

- 3518 sqft

- Single Family Home

Outstanding Fix & Flip Opportunity: Priced to Sell in North Phoenix

- Asking $299,000

- Beds: 3

- Baths: 2

- 1808 sqft

- Single Family Home

Priced for Profit: Phoenix Fix and Flip Opportunity

- Asking $280,000

- Beds: 4

- Baths: 2

- 1454 sqft

- Single Family Home

Exceptional Buy-and-Hold Opportunity: 5BR/3BA Home in Lakes Community at a Discounted Price!

- Asking $435,000

- Beds: 5

- Baths: 3

- 2644 sqft

- Single Family Home